Image Source: Google

Investing in the stock market can be a rewarding but daunting task. With constant fluctuations in stock prices and market conditions, it can be challenging to make informed decisions about when to buy or sell. However, with the help of real-time trade alerts, investors can stay ahead of the game and maximize their investment potential.

The Benefits of Real-Time Trade Alerts

1. Timely Information

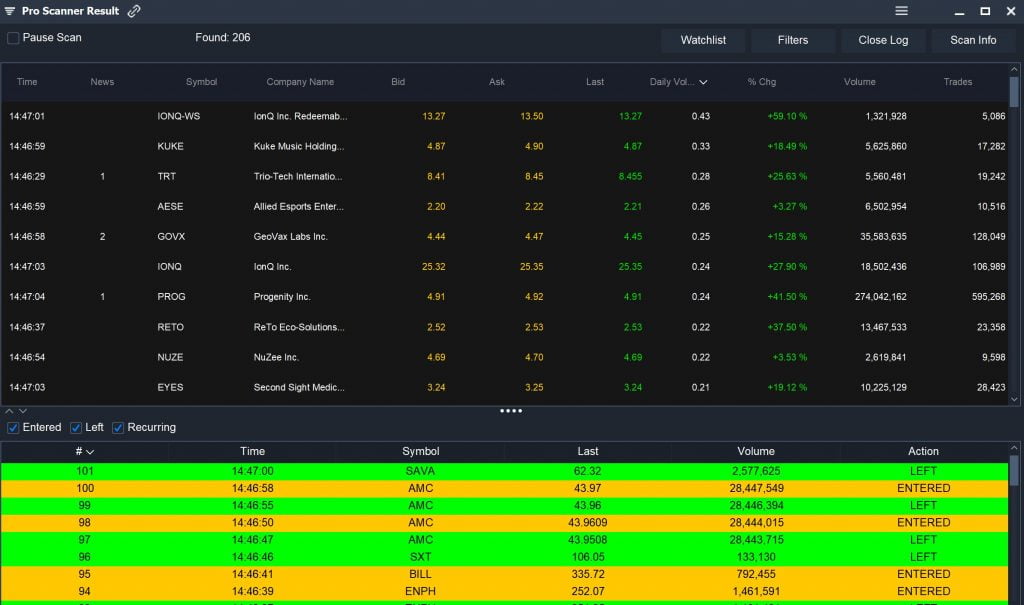

- Best real-time trade alerts provide investors with up-to-the-minute information on market trends, stock prices, and news that may impact their investments.

- By receiving timely alerts, investors can make quick decisions to capitalize on opportunities or mitigate potential risks.

2. Stay Informed

- With real-time trade alerts, investors can stay informed about their investments without constantly monitoring the market.

- Alerts can be customized to specific stocks, industries, or market conditions, ensuring that investors receive relevant information that is tailored to their investment strategy.

3. Enhance Decision-Making

- By receiving real-time trade alerts, investors can enhance their decision-making process by having access to relevant information when it matters most.

- Alerts can help investors analyze market trends, identify potential opportunities, and make informed decisions about when to buy or sell stocks.

How to Get Started with Real-Time Trade Alerts

1. Choose a Reliable Platform

- Research and select a reliable trading platform or service that offers real-time trade alerts.

- Ensure that the platform provides accurate and timely information to help you make informed investment decisions.

2. Customize Your Alerts

- Customize your trade alerts to suit your investment goals, risk tolerance, and trading preferences.

- Specify the stocks, industries, or market conditions you are interested in monitoring to receive relevant alerts that align with your investment strategy.

3. Set Alerts for Key Metrics

- Set alerts for key metrics such as stock prices, volume changes, and market news that may impact your investments.

- By monitoring these key metrics in real-time, you can make informed decisions and take action accordingly.

Tips for Maximizing Your Investment Potential

1. Stay Disciplined

- Stick to your investment strategy and avoid making impulsive decisions based on emotions or market hype.

- Use real-time trade alerts to stay disciplined and make informed decisions based on data and analysis.

2. Diversify Your Portfolio

- Diversification is key to reducing risk and maximizing returns in your investment portfolio.

- Use real-time trade alerts to identify opportunities for diversification and rebalance your portfolio accordingly.

3. Stay Updated on Market Trends

- Stay informed about market trends, economic indicators, and news that may impact the stock market.

- Use real-time trade alerts to stay updated on market conditions and make timely decisions to capitalize on opportunities or minimize risks.

Conclusion

Real-time trade alerts can be a valuable tool for investors looking to maximize their investment potential. By receiving timely information, staying informed, and enhancing decision-making, investors can make informed decisions to achieve their investment goals. To get started with real-time trade alerts, choose a reliable platform, customize your alerts, and set alerts for key metrics. By following these tips and staying disciplined, investors can effectively maximize their investment potential and navigate the stock market with confidence.